Demystifying Credit Card Routing Numbers: All You Need to Know

Welcome to our blog post on credit card routing numbers – a topic that often leaves people scratching their heads in confusion. Don’t worry, we’re here to demystify this essential aspect of your credit card and help you understand everything you need to know about it.

Whether you’ve been using credit cards for years or are just getting started, join us as we unravel the secrets behind these mysterious digits. Get ready to expand your financial knowledge and take control of your plastic money like never before!

Table of Contents

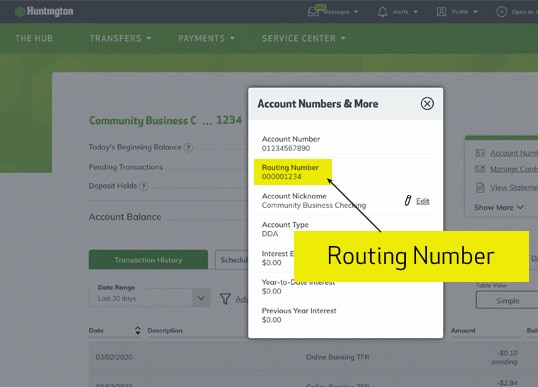

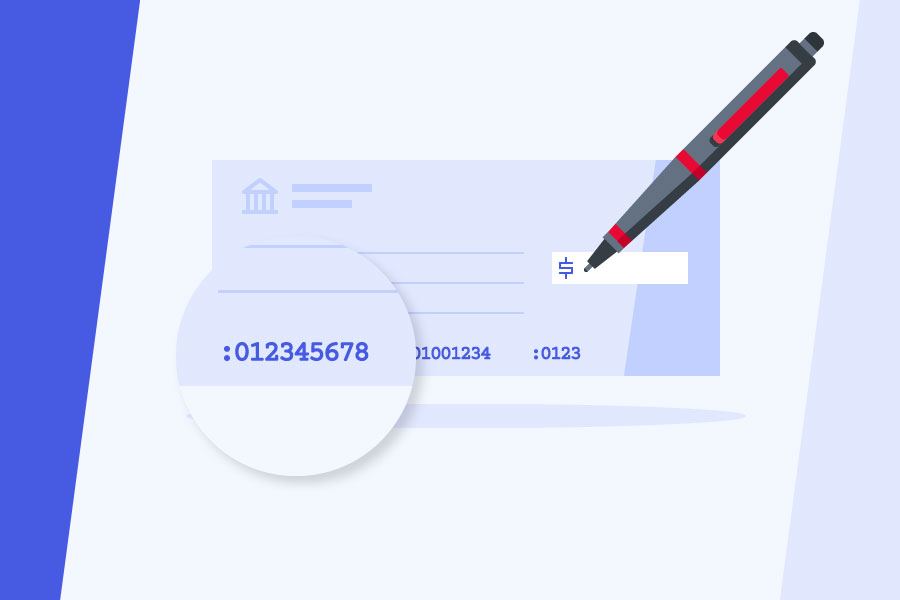

What is a Routing number?

A routing number is a nine-digit alphanumeric code that identifies an account and its corresponding financial transactions on a financial network. These codes are used by banks and other lenders to process and record electronic payments. The routing number is usually printed on the front of a credit card or near the bottom of the billing statement.

A routing number is also sometimes used to identify an individual bank account when making electronic payments.

Do credit cards have routing numbers?

Credit cards typically have a routing number associated with them that is used to process the card transaction. This number is assigned by the credit card company and is used to determine the correct charges to be placed on your account. Additionally, this information can be used to track your account activity and history.

How do credit cards use routing numbers?

Credit cards use routing numbers to track the flow of payment through the system. A routing number is a unique identifier for a credit card transaction. The credit card company assigns a routing number to each credit card account, and they use this number to process payments.

When you purchase with your credit card, the card company requests authorization from your bank. Your bank then sends along the funds (known as a payment slip) to the credit card company. The credit card company then uses the routing number on that payment slip to identify which merchant’s account should receive the money.

The merchant receives the payment and records it in their accounting system as well. The routing number helps to keep track of who owes what to whom and makes it easier for your bank and merchants to process transactions correctly.

If you have questions about how credit cards use routing numbers, you can ask your bank or credit card company.

Why do card companies use routing numbers?

Credit card companies use routing numbers to track transactions and identify customer accounts. When a customer makes a purchase, the credit card company not only calculates the transaction amount but also determines which bank performed the authorization. It then assigns a routing number to the bank account from which the purchase was made. The routing number helps identify the account holder and the purchase.

The routing number is also used for billing purposes. Whenever a customer pays for goods or services using his or her credit card, the credit card company not only debits the account but also sends a bill to the customer’s routing number.

What can you do if your credit card has a missing routing number?

If your credit card has a missing routing number, there are several things that you can do to try and figure out what happened. One possibility is that the card was lost or stolen, and the bank canceled it. In this case, you would need to contact your bank and see if they can help you get new cards put into place. If the card was just missing from the shipping process, then your bank likely just needs to send you a new card with the new routing number on it.

If you have confirmed that your card was lost or stolen, and you do not have another copy of the card, then it may be best to just cancel it and get a new one. This is important to keep in mind because if somebody were to use your canceled card without your permission, they could be charged with fraud. Any charges that occur will show up on your statement as though the purchase went through.

If you do not have confirmation that your card has been lost or stolen, but you do not have the card yourself and you believe that it was stolen, then you may want to contact the police to report the theft. Doing this will help increase the likelihood of finding your card and making a positive ID of the person who took it.

Conclusion

It can be tricky to know just what credit card routing numbers are, let alone how to use them. In this article, we have simplified everything for you by explaining each component of a credit card routing number and highlighting exactly what it is used for. Armed with this knowledge, you will be able to understand the purpose of each number and use them appropriately to protect your financial data.

So, next time you’re wondering what a particular number is used for, don’t hesitate to check out our article. Here, you will be able to understand everything from the basics of routing numbers to more complex uses. Armed with this knowledge, you can confidently protect yourself and your information whenever possible.